Related Articles

Stay updated with our latest content to stay ahead in the world of e-commerce

In connection with HUI Research, Postnord has published its quarterly analysis “E-Barometern,” which reveals the developments that took place in the Swedish e-commerce landscape in Q3. HDL Commerce delves into the analysis, scans for trends, and captures exciting development initiatives undertaken by various industries and e-retailers.

To summarize the situation we have been in (and continue to be in), we are still characterized by an unstable global situation, a recession, and inflation. Despite a slight decrease in inflation during the period, there are no indications of an improved economic situation ahead. The upcoming period with Black Friday and then Christmas is therefore in a dual situation where consumers, according to the Economic Institute’s household indicator (Konjunkturinstitutets hushållsindikation), on one hand seem to be more positive about the future and in a festive Christmas spirit. This contrasts sharply with the fact that households, on the other hand, continue to be affected by high interest rates and large expenses.

When it comes to e-retailers, the situation remains tough as consumers become more economically conscious, while purchasing costs still are on the rise. Many e-commerce companies have been grappling with increased costs for a long time, unable to pass them on to consumer prices. Nevertheless, the percentage of e-retailers expecting a decrease in sales during the last months of the year is lower this year than last year, 38% compared to last year’s 48%. Increased creativity and flexibility from e-retailers have been and will continue to be necessary to meet changing consumer buying habits and expectations.

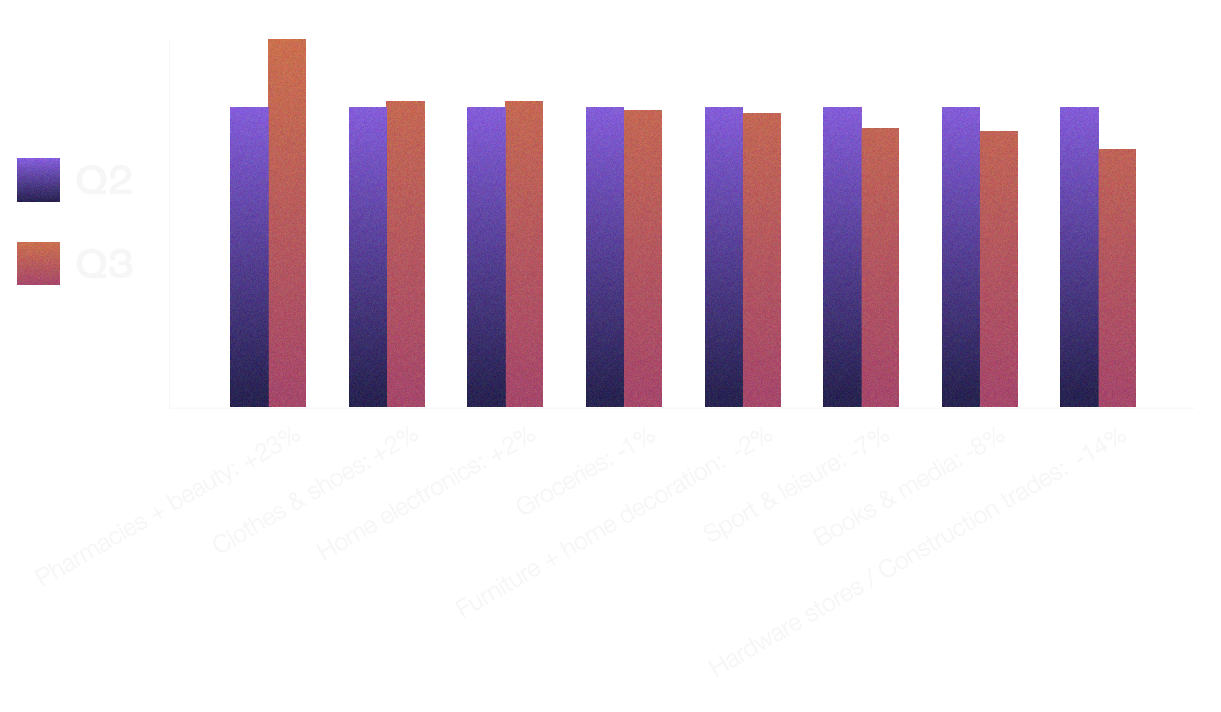

For the first time in a long while, e-commerce shows a weak but still positive development, with a 2% growth during the quarter. The growth might be pushed by inflation and the fact that a few industries account for the majority of the increase, while others continue to struggle however there is still optimism for the future. Nevertheless, significant disparities in development between different industries persist, with a 37 percentage point difference between the figures of “Pharmacy + Beauty” and “Hardware stores / Construction trade”.

The various industries have faced different types of challenges and have also developed different ways to move forward in their strategies.

A common feature for these industries is that they have developed technical features to reach their target audience in new ways in order to survive (and in some cases thrive) in today’s challenging climate. “Thinking outside the box” is more important than ever, and in order to do this e-retailers need a platform, such as HDL Commerce, that supports them in being agile, offering easy scalability, developing new features, and providing high potential for adding new integrations. The choice of a platform must be made with great care and can, especially in times like this, tip the scale between bankruptcy and survival with the further possibility of success.

Financial worries drive increased demand during Black Week, especially among young people and parents of children. Despite an increased tendency to postpone purchases during Black Week in times of economic uncertainty, the percentage of those planning to shop remains relatively stable. Black Week has established itself as a strong tradition among Swedish consumers since 2018. Shopping patterns during Black Week are driven by both desire and necessity, with increased demand for clothing, shoes, and home electronics. Consumer attitudes counter-reactions like ‘Green Friday,’ reflect an increased awareness of sustainability in purchasing behaviors.

Due to economic concerns, many consumers choose to delay their purchases until Black Week. Because of this, thoughts turn to communication regarding Black Week offers. Taking a closer look at what consumers actually think, e-barometer indicates that 52% are skeptical of the marketing surrounding Black Week. So, how should retailers really approach this issue? E-barometer suggests a need for balance in marketing to maintain trust with customers.

Due to the shifting buying behaviors and needs of both retailers and consumers, HDL Commerce has developed an e-commerce platform that can be customized to facilitate and optimize shopping experiences, especially during periods like Black Week with increased traffic.

The annual online Christmas shopping shows positive growth of 0.4 billion Swedish kronor, according to the E-barometer. Dominant categories include books and media, as well as clothing and shoes, with increased interest in beauty and health products online. Despite economic challenges, consumers are maintaining their Christmas gift budgets, and e-commerce is expected to capture a larger share, especially among younger demographics. The role of e-commerce remains significant, and timing becomes increasingly important for online Christmas shopping, especially around Black Friday.

Physical store consumers are exhibiting a growing trend of advancing their Christmas gift purchases to Black Week. Interestingly, perceptions of delivery times between consumers and retailers still differ significantly, where companies estimate they can deliver packages later than what consumers expect. This year, Christmas Eve falls on a Sunday, further impacting consumer hesitancy towards late delivery dates. Many are likely not daring to place orders later than December 14th-16th, while companies consider December 19th-20th as the latest possible date.

During a recession, consumer awareness becomes crucial for success. Companies need to align their expectations with consumer needs to avoid future challenges. Difficulties in inventory planning, the impact of the pandemic, and price developments create uncertainty factors. Black Week positively affects sales for a significant portion of retailers, but the relationship between campaigns and profitability remains a challenge.

It has also become increasingly common for Christmas sales to shift to Black Week, with many consumers choosing to buy their Christmas gifts during the sales. Price comparison sites and low-price giants make it difficult for retailers to sell at full price, and consumers’ growing focus on promotional periods intensifies the competition for the lowest price. A new rule about companies providing information on price reductions and promotions may impact how companies use sales and promotions, and additional legislation is being discussed. Consumers’ increased price consciousness puts pressure on e-commerce companies to carefully consider pricing during the last months of the year. For retailers, it is becoming increasingly critical to have a platform that streamlines inventory management, pricing, and promotions, enabling smooth navigation during intense sales periods. Having an online business on a platform that keeps pace with market developments and the regulations implemented for businesses, such as HDL Commerce, is becoming more and more crucial for retailers.

In order to survive and perhaps even experience a positive development in e-commerce during these times, it is necessary for a company to be willing to think outside the box and not be afraid to try new ways to meet consumer expectations. In a turbulent world, not only do the needs of the consumers change, but their attitude towards consumption also evolves. We see a clear path where consumers must consider their needs more and, consequently, set aside their desires to a greater extent. It is crucial right now to be able to highlight why your products primarily address a need. The upcoming period is filled with campaigns, and the traffic to e-commerce sites is likely to increase dramatically, regardless of whether purchases are made. Having a platform with the capacity to handle a large number of visitors and high site traffic is crucial in times when customers are already holding onto their wallets tightly. If there’s one thing an e-retailer can’t afford during these times, it’s losing sales opportunities due to a platform that doesn’t meet the standards. Additionally, it can be a good idea to invest in relevant development for your e-commerce even in tougher times, both to reduce the buying threshold for consumers and to demonstrate that you are a market player to be reckoned with.

At HDL Commerce, we are experts in helping you take your e-commerce to a new level. We assist you in finding opportunities in what may seem like an impossible situation and are a reliable partner both in good and challenging times. More information about our offerings can be found at https://hdlcommerce.com/, and we would be more than happy to schedule a meeting with you! Contact us through the contact form on the website and let us help you take your e-commerce to new, uncharted heights.

Related NEWS and articles FROM HDL COMMERCE